High Performance, Established Leadership

The Fund leverages Cantor Fitzgerald and Capital Innovations' extensive experience in financial markets, asset management, and infrastructure investing.

Adviser

Cantor Fitzgerald Investment Advisors, L.P.

Cantor Fitzgerald Investment Advisors, L.P. (the “Adviser”) is registered as an investment adviser with the SEC pursuant to the Advisers Act of 1940 (“Advisers Act”). The Adviser is a division of Cantor Fitzgerald Asset Management (“CFAM”), which provides investment management, asset management and advisory services to investors in global fixed income, equity, and real assets markets through the use of mutual funds, exchange traded funds, separately managed accounts, interval funds, non-traded REITs, opportunity zone funds and other private investment vehicles. The Adviser is a wholly-owned subsidiary of Cantor Fitzgerald, L.P. (“Cantor Fitzgerald”).

The Adviser will leverage the size and scale of Cantor Fitzgerald, the parent company of the Adviser, to support the day-to-day management of the Fund.

A Tradition of Excellence

Since 1945

Cantor Fitzgerald’s 80 years of experience through market cycles combined with vertically integrated businesses across real assets, investment management, investment banking and research allow the firm to quickly identify and execute on market opportunities.

With a long-term focus on value creation combined with real-time data from their global market presence, Cantor Fitzgerald is positioned to create best in class investment solutions for its investors.

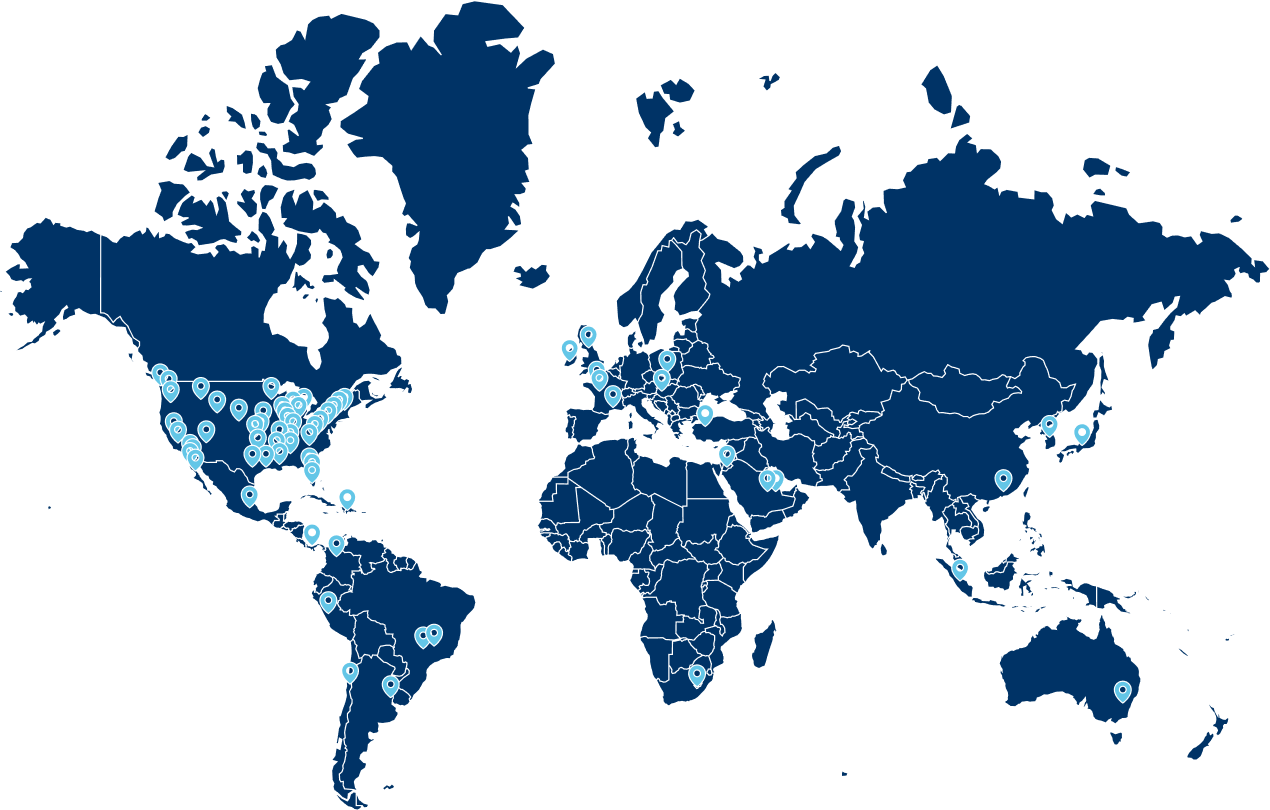

Global Footprint

160+ offices and trading desks located in major financial centers around the world

Investment Grade

Maintains an investment-grade credit rating by Standard & Poor’s and Fitch

Expansive Team

Across all platforms, Cantor Fitzgerald has more than 14,000 employees worldwide

Primary Dealer

One of the 24 primary dealers authorized to transact business with the Federal Reserve Bank of New York

Over $87 Billion

In real assets-related transactions in 2024*

$25 Billion

Total infrastructure transaction volume since 2018

*Includes originated debt and non-originated debt placement transactions.

Cantor Fitzgerald refers to Cantor Fitzgerald, L.P., its subsidiaries, including Cantor Fitzgerald & Co., and its affiliates including BGC Group, Inc. (NASDAQ: BGC) and Newmark (NASDAQ: NMRK).

The map is a partial representation of offices for Cantor Fitzgerald, L.P., its subsidiaries, including Cantor Fitzgerald & Co., and its affiliates including BGC Group, Inc.

(NASDAQ: BGC) and Newmark (NASDAQ: NMRK)

Sub Advisor

A Real Assets Specialist

Since inception, Capital Innovations, LLC (the “Sub-Adviser”) has applied a sustainable investment approach to their suite of real assets investment solutions including infrastructure, real estate, commodities, agriculture, and natural resources.

The Sub-Adviser was founded to enable investors to benefit from the transition to a resource constrained economy. Today’s most forward-thinking companies are responding to the challenges and opportunities created by population growth, natural resource scarcity, climate change, urbanization and globalization.

Infrastructure Expertise

Advised on or invested in more than $9 billion worth of infrastructure opportunities in both public and private markets

Time-Tested Approach

Experience through multiple market cycles and economic environments

Experienced Team

Decades of infrastructure, real assets and portfolio management experience